HELP US RAISE AWARENESS, USE THE SOCIAL MEDIA BUTTONS BELOW TO SHARE THE BILL INFORMATION WITH YOUR FRIENDS

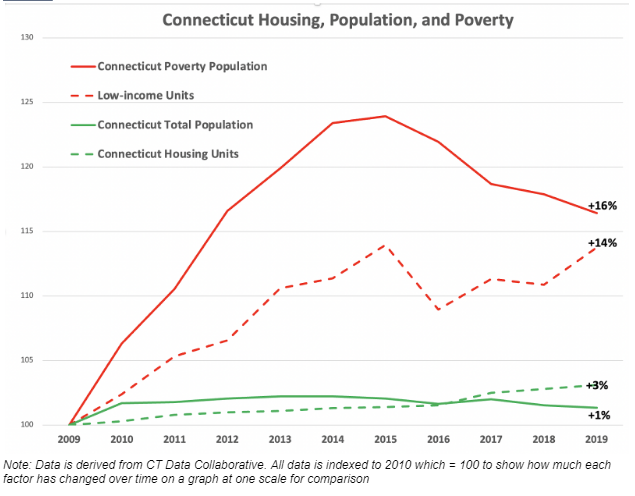

Good intentions are no excuse for enacting poor public policy. The “affordable housing crisis” in CT as mentioned by housing advocates is really due to increase in poverty in CT. Poverty increased by 16% and low income housing units increased by 14%, meanwhile overall population in CT increased by only 1% and overall housing units in CT increased 3% overall.

The increase in poverty is attributable to the lack of good employment opportunities in CT and poor economic and business public policy. Lack of good jobs leads to lower income and less residents can afford to buy or rent existing market value homes in the region.

In CT over 50% of housing vouchers meant to assist those that cannot as easily afford market rent are not used, because among other reasons, individual Housing Authorities put undue restrictions on the vouchers that prevent portability and the individual voucher amounts have not kept up with the increasing rents. Reforming housing vouchers is a more efficient way to address Affordable Housing concerns. This would give greater flexibility to recipients to move where they want and it would also help to preserve naturally existing affordable housing. The onerous zoning bills instead take away local zoning authority, allow “as of right” 80-100% of high density multifamily market value rental development and are just a gift to developers. Read more for CT Investigator about dysfunctional housing vouchers program in CT here.

Zoning bills entirely exclude cities, where public transportation and infrastructure already exists. In addition, cities receive significant State funding for infrastructure and education from the state’s coffers in PILOT and ECS grants, while the targeted suburban communities that are the focus of these bills rely almost entirely on local property taxes to fund their schools and infrastructure.

The greatest challenges for CT that are not being addressed:

1) Increasing the vitality of our state by bringing back industry, new jobs and higher paying salaries through business-friendly public policy. Development should be focused on revitalizing commerce in all of our state, including our cities and rehabilitating existing dilapidated housing stock.

2) Improving overall affordability in CT. A recent US News report showed that CT is 46th out of 50 states in overall affordability and yet 19th when looking at only housing costs, for an overall affordability ranking of 40%. CT has the second highest taxes in the country. CT needs to become more tax friendly to all of its residents rather than forcing overdevelopment of market value units that do not address affordability. Read the US News Report here.

Click “+” to expand.

As-of-right development takes away public hearings on individual multifamily projects within any community. Those that live closest to a project in every neighborhood deserve to discuss the potential impacts to their own properties. (SB157, HB6633, HB6593)) Those with the most factual, evidenced based information on direct environmental and logistical impacts to the neighboring properties, like water runoff, well limitation issues, wetlands, etc. no longer have a voice. As-of-Right development prohibits local P&Z from addressing any infrastructure impacts resulting from an individual project by allowing a local P & Z to impose conditions. Currently P&Z Commissions can impose conditions on approval. In other states, such as MA’s recent Transit Oriented Development legislation allows towns to impose fees to address these impacts.

SOLUTION: DO NOT ALLOW “AS OF RIGHT” Multifamily Development

Desegregate CT’s SB157, will allow 20-30 units/acre on a “reasonable amount of land” within half mile of transit station or 10 units/acre in 25 acres near a village center targeted for TOC development for towns bordering a transit town. For all that density, it only requires 18% affordable for 10 units or more development to build as of right, while 8-30g requires 30% affordable to develop as of right properties and override existing local zoning rules.

HB6593 will allow any outside Housing Authorities anywhere in CT to build in any other municipality without getting the other town’s prior consent. It allows developers to bypass towns’ current INCLUSIONARY zoning laws that have more robust requirements (some at 15% or 20% to be affordable) and will lead to towns being flooded by market value luxury condos again with little affordability. Who will be responsible to maintain those properties? This drives DOWN the ratio of affordable units to total units, making it impossible for towns to meet the 8-30g 10% affordable housing threshold.

HB6633 _ Fair Share bill will end single family zoning forever. It allocates and onerous unattainable fair share of units for development with set development deadlines; 3 yr=5%, 5 yrs = 30% 6 yrs = 50%, 10 yrs =100%. If not met, all areas on town water and sewer are “as of right” to develop 30 units/acre with only 20% affordable required. Developers can pay to extend sewer and water and build 30 units per acre. Anything outside that area is “as of right” as much as the well and septic capacity can handle with 1 unit - 10% of all units affordable required.

SOLUTION: Provide state seed funding to towns developing 100% affordable through their own Housing Authorities

Fair share mandates in New Jersey have not increased affordability of New Jersey and it remains one of the highest taxed states in the country. CT is already #2 highest taxed state.

Work Live Ride, SB157 grants “As of Right” Development without any specific language on affordability – “affordability based on state housing needs assessment.” Providing affordable housing is very costly to builders, so builders will apply for just under the minimum units without building even one affordable unit. They may even subdivide plots in downtowns to stay below the threshold units. This can lead to predatory overdevelopment while driving down ratios of affordable units to total units in a town, taking towns farther and farther away from 10% affordable requirement under 8-30g.

Flooding high-cost areas, like Fairfield County with housing supply will not drop home prices enough to make them affordable by low-income earners. For example, a builder will buy and tear down one single family home that cost $1 million and build 9+ luxury units selling at $750K or more each or charging $6000+ a month for rent on a 2BR apartment. Low-income earners (60% of Median Income) can only afford up to $1,200 per month for a 2BR. Even if home prices are reduced by 50% driven by increase in supply, it is still not affordable by low-income earners in Fairfield County. (SB157 Work Live Ride DesgregateCT, HB6633 - Fair Share, HB6593 - Housing Authorities)

SOLUTION: Provide state seed funding to towns developing 100% affordable through their own Housing Authorities & DO NOT PERMIT “AS OF RIGHT” Development. Towns can create inclusionary policy to require affordability with each project.

Sara Bronin stated in 2021 that if you flood the market, the state and towns will get extra revenues that can be used to do "cool stuff with." Yes, at no cost to the state, but at a significant cost to every town that has to deal with all the infrastructure costs from the predatory exponential market value multifamily over development, when P&Zs cannot pass some of those construction costs from a specific development project onto the developer and the costs will instead be incurred by the taxpayers in higher local property taxes.

Exponential growth stresses the town’s infrastructure, i.e. as builders max-out the property coverage on each lot, resulting in greater stormwater runoff. The towns’ existing drainage and wastewater treatment systems will be overwhelmed. There is actually language in proposed legislation that mandates the expansion of sewer and other infrastructure. Many of the towns being targeted, in particular in Fairfield County, receive little to no funding (of ECS, PILOT grants, school construction funding, housing development) from the state to address any such impacts. Those costs are not incurred in a linear line, but can instead step-up, like when you need to build a new fire station, expand existing sewer systems capacity or build extra cafeteria for schools so kids are not eating lunch at 10:30am. Those costs will all be incurred by the local municipalities and passed on to the residents through a reduction in local services or an increase in mill rate/property taxes. Local P&Zs must decide where and how “as-of-right” ADUs, Accessory Apts, Multi-family, mixed use are best zoned. HB6633 - Fair Share, HB6593 - Housing Authorities, SB909 - Housing as a right, SB157 Work Live Ride DesgregateCT

SOLUTION: Fix the housing voucher system to allow those with housing need to have greater choice on where to live. They will have access to market value naturally existing affordable housing.

For TRUE Transit Oriented Development any community must have DEDICATED RAPID MASS TRANSIT defined as 15 minutes or less. Metro North does not qualify as it is a commuter line, not rapid transit! Simply having a bus line is also not “rapid mass transit.”

The development must include thoughtful commercial, corporate and residential development, which Desegregate CT’s SB157 does not. It is focused on exponential market value residential development in the 1/2 mile around any bus or train transit stations and around downtown with limited affordability attached. (SB157– DesegregateCT Live Work Ride,)

SOLUTION: Improve transit first. Build it and they will come is costly and not addressing the real need. It is only a gift to developer lobbyists, like RPA.

Many suburban towns were settled over a century ago. The local roads are often not wide enough to allow for on-street parking on both sides of the street, along with a pedestrian walkway and two-way traffic. Eliminating parking requirements results in residents parking on-street or taking downtown lot spaces that local businesses rely on desperately. Forcing cars to park on-street will make the roads and sidewalks more dangerous for pedestrians, cyclists and cause unwanted congestion. Assumptions that residents will not need cars to get to their jobs, shopping, schools, doctors in CT is a fallacy as most of our transit is not MASS TRANSIT, but COMMUTER TRANSIT.

(HB6107, which passed in 2021, allowed municipalities to OPT OUT of Off-street Parking Requirements: Last year’s bill, which limits a municipality’s ability to require off-street parking spaces to only 1 space for a studio and 1BR apt and 2 spaces for 2+BR apts. All but 2 municipalities in WestCOG (cities, suburbs and rural communities) opted out of the requirement as municipalities know that “one size fits all” mandates are poor public policy and do not provide towns enough flexibility to meet their unique needs now, or in the future.

Yet legislators are yet again putting these bad policy concepts into the bills in 2023!

SOLUTION: Work collaboratively with stakeholders in every town. Stop proposing one size fits all bills that are nothing but poor public policy!

- There are bipartisan concerns on the environmental implications of zoning proposals looking to urbanize suburbs and rural Connecticut. Dense development is proposed to center around coastline train stations along Metro North Rail. DEEP, CT's Environmental Protection Agency has a whole page dedicated to Sea Level Rise in CT and provides its studies to municipalities to assist with better planning of conservation and development. Instead of forcing TOD densification in low-lying, flood-prone areas that are susceptible to storms like Sandy, and we should rely on P&Zs to determine the best locations to build affordable and sustainable housing.

- Takes away the rights of a Conservation Commission or Regional Water Authorities from weighing in on the development of as-of-right multi-family units.

- Loosens septic restrictions to experimental septic systems that have recently had high failure rates, which then become a public health concern of the towns.

- Smart growth around transit stations prevents suburban crawl and public transit can be leveraged to reduce carbon emissions from vehicles. However, suburban residents will continue to require cars for transportation in their daily routines. Few, if any, local residents can use Metro North as a mode of transport between nearby towns. Public schools are often not located near downtowns or transit. Goods and services in Fairfield County are also priced at a premium to offset higher land prices. Low-income earners will need to shop in less expensive areas, but Metro North fare is very expensive and unaffordable for low-income earners

SOLUTION: DO NOT ALLOW “AS OF RIGHT” MULTIFAMILY DEVELOPMENT

- As-of-Right multi-family developments are detrimental for the architectural character of New England, a fundamental element that attracts and distinguishes us from all other States.

- Historic homes are easy targets for developers because they are relatively undervalued compared to new turn-key properties, and the restoration alternative proves more time consuming, which translates to higher costs for developers.

- These structures and spaces give each of our towns a unique architectural fabric and speak to our development, but we will continue to lose our remaining historical properties and our town centers unless we pass laws to protect and incentivize preservation.

SOLUTION: DO NOT ALLOW “AS OF RIGHT” MULTIFAMILY DEVELOPMENT

In 2021, HB6107 removed consideration for maintaining property values in zoning.

Single family home ownership is the American Dream for most. We are seeing the expansion of home ownership among all demographics in CT and throughout the country. For most, home represents their largest asset, and the appreciation of which creates generational wealth and the nest egg to help afford their retirement later in life.

Now, we see that the legislative majority is giving a gift to developers with as of right market value development without creating necessary affordability. Such exponential overdevelopment will only increase our already 2nd highest taxes in the country and that will ultimately lead to a devaluation of properties and an even greater out migration from our state. Our residents deserve better.

SOLUTION: PROTECT LOCAL MUNICIPALITY RIGHTS AND LOCAL ZONING DECISION MAKING

Housing advocate-heavy appointed working groups have been formed by 2021’s HB6107 to create form-based zoning codes, and develop guidelines: “carrots” and “sticks” for municipalities to comply with affordable housing and variety of housing choice through municipal zoning regulations, to allocate “fair shares,” to determine enforcement policies. Over 75% of those housing advocates all testified IN FAVOR of greater state control of zoning and the onerous zoning bills. Concerns include 1) will the codes will be optional or mandated and 2) the makeup of the committees DOES NOT include proper representation of all types of municipalities, in particular, suburban and rural communities so their concerns are adequately voiced through the group’s recommendations. It is clear from the draft reports of these working groups that they are a rubber stamp of the Housing Advocates’ agenda of 1) turning every suburb into a small city and 2) ending single family neighborhoods in CT. (HB6633, HB6593, SB909, HB6650, SB915, SB157)

SOLUTION: LAND IS FINITE AND UNIQUE - DO NOT PASS ONE SIZE FITS ALL LEGISLATION!

Local housing authorities and local P&Zs are best equipped to determine proper sighting and infrastructure impacts of any development project. (HB6593) Any Housing Authority, anywhere in CT can build in any other town without that town's permission! This is a total loss of local zoning oversight, by allowing any outside Housing Authority, or regional Housing Authority to build in any other town that it chooses. This raises red flags right away and is a total loss of local planning and zoning control for every city, suburb and rural community in CT.

Who will be responsible for the maintenance of the affordable projects? What if there are issues in the upkeep of the projects. We have received reports of negative reviews of Elm City Communities, the New Haven Housing Authority as an affordable housing management company. They testified that they want to build in other communities. Why should they be allowed to build in another municipality without that town’s consent, especially when some public reviews are not favorable?

SOLUTION: REQUIRE LOCAL MUNICIPALITIES TO APPROVE ANY ATTEMPT BY AN OUTSIDE HOUSING AUTHORITY TO BUILD IN THEIR TOWNS.

“Fair Share” Calculator by Town

Consider the below example playing out at the same time in virtually every town – forced by state edict to double or triple their housing stock or face potentially ruinous lawsuits. Exponential multifamily overdevelopment when the state population has been declining due to poor economic policy that is chasing businesses out – policies that are churned out by the very same Leadership that is now proposing these ill conceived housing bills?

The fatal flaw of this bill is that it is not based in reality. In calculating fair share they rely mainly on grand list, income, poverty (all three of those highly correlated already), and existing multifamily housing. There is no capacity assessment to consider the infrastructure impacts of the allocations on individual towns.

IMPACT OF FAIR SHARE – UNITS AND COST BY TOWN

1. Total housing stock, calculated total affordable and % affordable per the state’s “2022 8-30g Affordable Appeals List”

2. Housing stock per Open Communities Alliance (OCA), fair share units and % of total housing stock per OCA’s “Downloadable Worksheet”

3. Calculated GROSS units a town would need to permit a builder for development = 20% total mandated fair share + remaining 80% market value to the developer as well future total housing stock post-development and % increase in housing stock.

4. Calculated cost to town’s taxpayers to build 100% of their affordable fair share at a minimum range of $250/unit to $450/unit and cost amounts to the municipality by the mandated completion % at 3,5,6, and 10 years.

| Town | Existing Housing Units* | Number of Affordable Units Required by Fair Share* |

Total Housing Units After Fair Share is met |

|---|---|---|---|

| {{vm.myTown}} | {{vm.current}} | {{vm.affordable}} | {{vm.current + vm.affordable}} ({{vm.percentage}}% Increase) |

| Town | Existing Housing Units* | New Units Required if ONLY 10% Must be Affordabe |

Total Housing Units After Fair Share is met |

|---|---|---|---|

| {{vm.myTown}} | {{vm.current}} | {{vm.affordable10}} | {{vm.current + vm.affordable10}} ({{vm.percentage10}}% Increase) |

| Town | Existing Housing Units* | New Units Required if ONLY 20% Must be Affordabe |

Total Housing Units After Fair Share is met |

|---|---|---|---|

| {{vm.myTown}} | {{vm.current}} | {{vm.affordable20}} | {{vm.current + vm.affordable20}} ({{vm.percentage20}}% Increase) |