Finance Committee Bill and Why We Oppose It

Click “+” to expand

- Establish a STATE PROPERTY TAX on residential and commercial real property, and exempts first $300,000 of the assessed residential value. Calculated based on the percentage of affordable housing developments, as defined in section 8- 30g of the general statutes, located in a municipality as follows:

- for > OR = to 10 % affordable, 0 mill

- from 8% to < 10%, 0.4 mill

- from 6% to < 8%, 0.8 mill

- from 4% to <6%, 1.2 mill

- from 2% to <4%, 1.6 mill

- From 0% to <2% 2.0 mill

How to calculate this unprecedented STATE PROPERTY TAX: Only municipalities tax property now!

Assume a home or business property with an ASSESSED value of:

$500,000: $500,000-$300,000= $200,000/1000= 200 and if only 0-2% affordable, $200 * 2.0 mill = $400 add’l state property tax

$1,000,000: $1,000,000 – $300,000= $700,000/1000= 700 and if only 0-2% affordable, $700 * 2.0 mill = $1,400 add’l state property tax

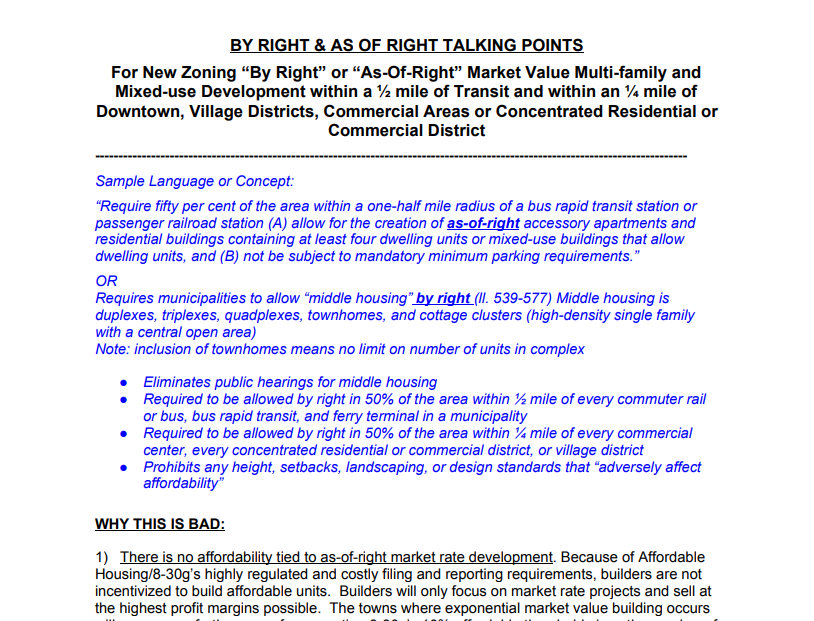

- IF THIS BILL IS COMBINED WITH THE NUMEROUS ZONING BILLS FLOODING OUR TOWNS WITH MARKET VALUE DEVELOPMENT (with a density of 15+ units PER ACRE), ratio of Affordable Housing will be driven DOWN relative to the increased total housing stock. We will be set-back and paying even higher mill rates of state-wide property tax than we are now!

- This Bill will disproportionately impact towns closest to NYC, with higher land costs. It will have a negative effect on the real estate market in Fairfield County at a time when it is finally just recovering from a long period of depressed values. CT is the only state in the country where property values have not recovered to where they were prior to the Great Recession.

- It is further concerning that this property tax will be tied to existing natural affordable housing not recognized by 8-30g. The current 8-30g guidelines specifically excludes any naturally existing market value affordable housing that is not deed restricted or built roughly before 1990. Naturally affordable properties certainly exist in every municipality and have not been quantified and ADUs and Accessory Apartments should be part of that calculation.

- We have seen from past tax increases in recent years that this will have a chilling effect on the upper end of the Fairfield County real estate market. So, why should legislators cares?

- Highest-income earners have the greatest mobility to establish residency elsewhere in states with more favorable tax structures.

- Net outmigration prior to COVID has reduced property and income tax revenues. Covid-19 has permanently changed how we live and work. Employees may no longer need to be geographically tied to NYC. This greater flexibility means that now more than ever CT must become more competitive since CT will no longer be competing just with our neighboring states but essentially the entire country.

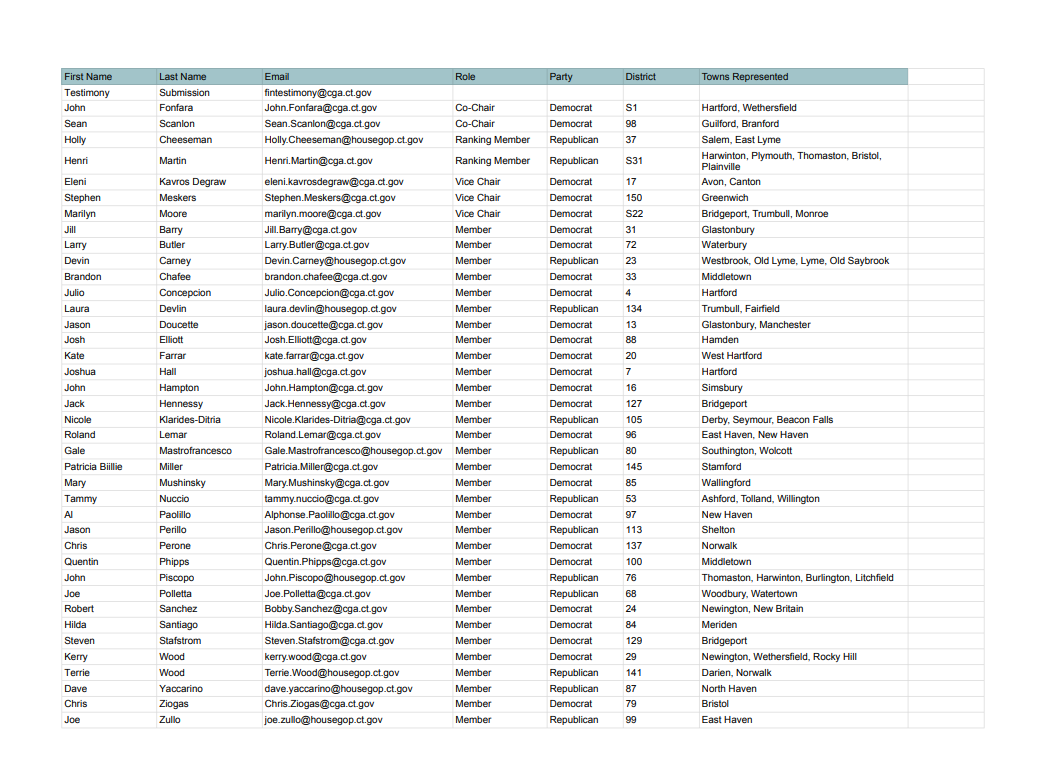

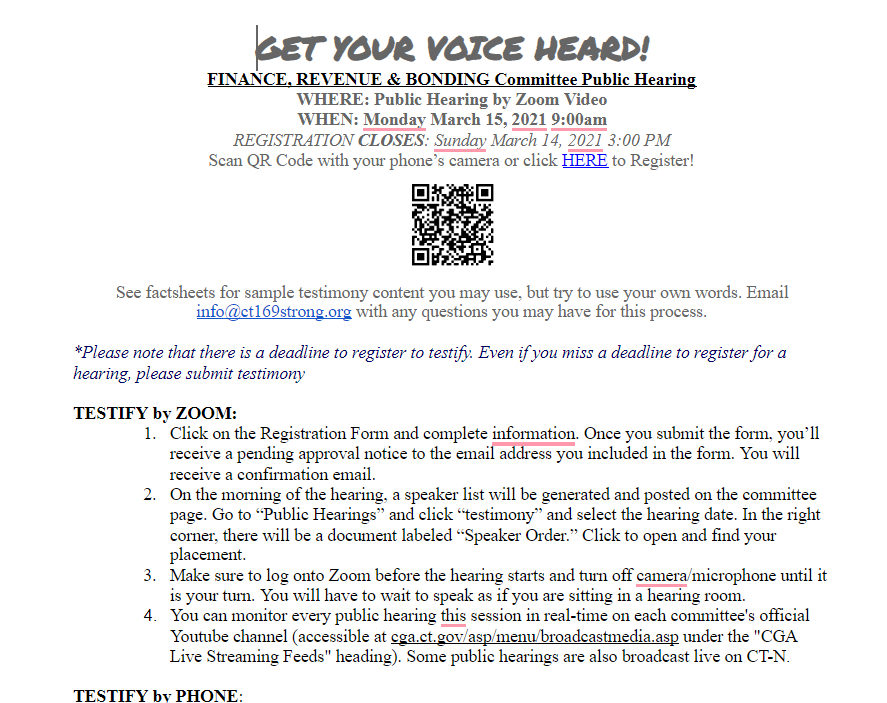

Submit a Testimony to the Finance, Revenue and Bonding Committee

The following action should be done on your computer, not a mobile device, as you will need to save and re-attach the PDF file. Email CT169Strong with any questions you may have for this process.

1. Enter your email, first and last name below, select your town, and hit the LOAD TESTIMONY button.

2. Edit the sample testimony in your own words. Explain why you oppose the bill and offer suggestions to improve it. See Summary of Concerns and the above Bill info section if you want to include more content.

3. When you are done hit SAVE TESTIMONY button and open the downloaded PDF file to check the contents. If you are not happy with the contents of your file, you can repeat Steps 3. and 4. as many times as you want.

4. Once you are happy with the contents of your testimony, hit EMAIL TESTIMONY button to open an email, attach the testimony file you saved in Step 4, and hit SEND.